Evaluation of a new international policy instrument to curb offshore tax evasion

Global information sharing of bank information

Hjalte Fejerskov Boas (University of Copenhagen), Niels Johannesen (Oxford University Centre for Business Taxation), Claus Thustrup Kreiner (University of Copenhagen), Lauge Larsen (University of Copenhagen), Gabriel Zucman (Paris School of Economics and UC Berkeley)

While the financial secrecy of offshore tax havens has historically created ample tax evasion opportunities for wealthy individuals, automatic information exchange between tax authorities is an ambitious attempt to make tax enforcement possible. This column summarizes recent research documenting that information exchange creates large improvements in tax compliance through repatriation of offshore wealth, self-reporting of offshore financial income and audit efforts targeted offshore evasion.

In the past decade, more than 100 countries – including all significant offshore financial centres – have adopted automatic exchange of bank information. They now systematically collect information about bank accounts owned by foreigners and automatically provide this information to the relevant foreign tax authorities. The information exchange concerns personal financial wealth, whether held directly or indirectly through a holding company, a trust or similar.

The objective of automatic information exchange is to curb offshore tax evasion, an important policy challenge in a globalized world. Empirical research documents that personal wealth in offshore tax havens amounts to trillions of dollars (e.g. Zucman, 2013), that it belongs overwhelmingly to the very wealthiest individuals (e.g. Alstadsæter et al., 2018a, 2018b, 2019) and that it has – at least until recently – largely evaded taxation.

In a recent paper, we study the effects of automatic information exchange on tax compliance (Boas et al., 2024). Our laboratory is Denmark where we create a unique data infrastructure covering all the 300,000 information reports on foreign bank accounts received by the Danish authorities, matched to micro-data on income, wealth, and cross-border bank transfers for the roughly 5 million adult taxpayers.

Repatriation

We first ask whether automatic information exchange induced taxpayers with offshore bank accounts to repatriate assets, levering the transaction data on money transfers from tax havens.

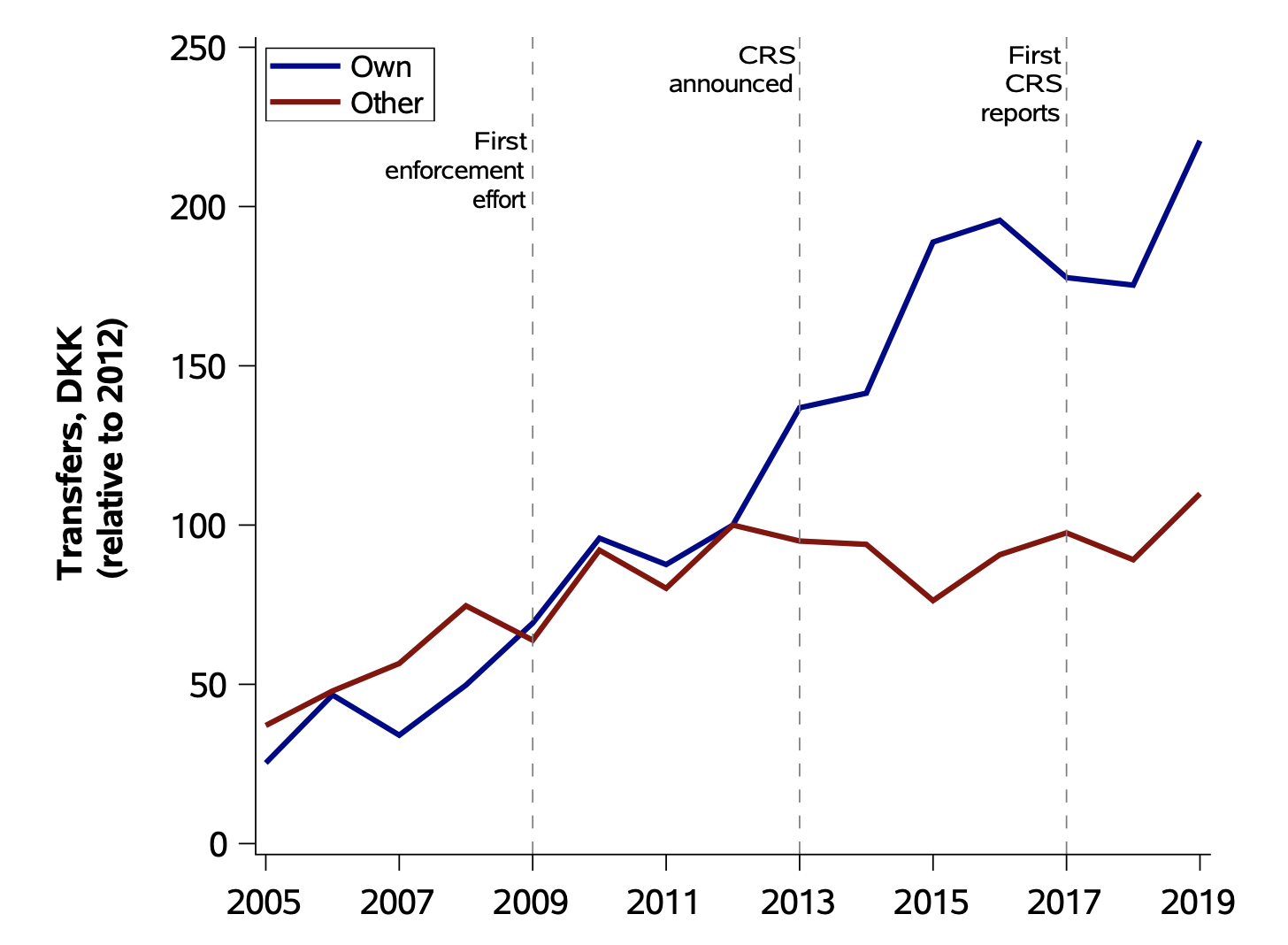

As shown in Figure 1, transfers from people’s own accounts in tax havens (“repatriations”) increased differentially relative to other transfers from tax havens (“other transfers”) from 2013. This points to strong repatriation responses induced by the G20 decision to make automatic information exchange the new global standard and the subsequent efforts to implement this decision.

We also document that repatriations from tax havens were associated with one-to-one increases in total wealth on the tax return and commensurate increases in taxable capital income and tax liabilities. This implies that the repatriations come from non-compliant accounts and involve an increase in tax compliance.

Figure 1

Figure 1

Self-reporting

We then consider whether taxpayers who did not repatriate their foreign assets became more likely to self-report the financial income on foreign accounts at the onset of automatic information exchange.

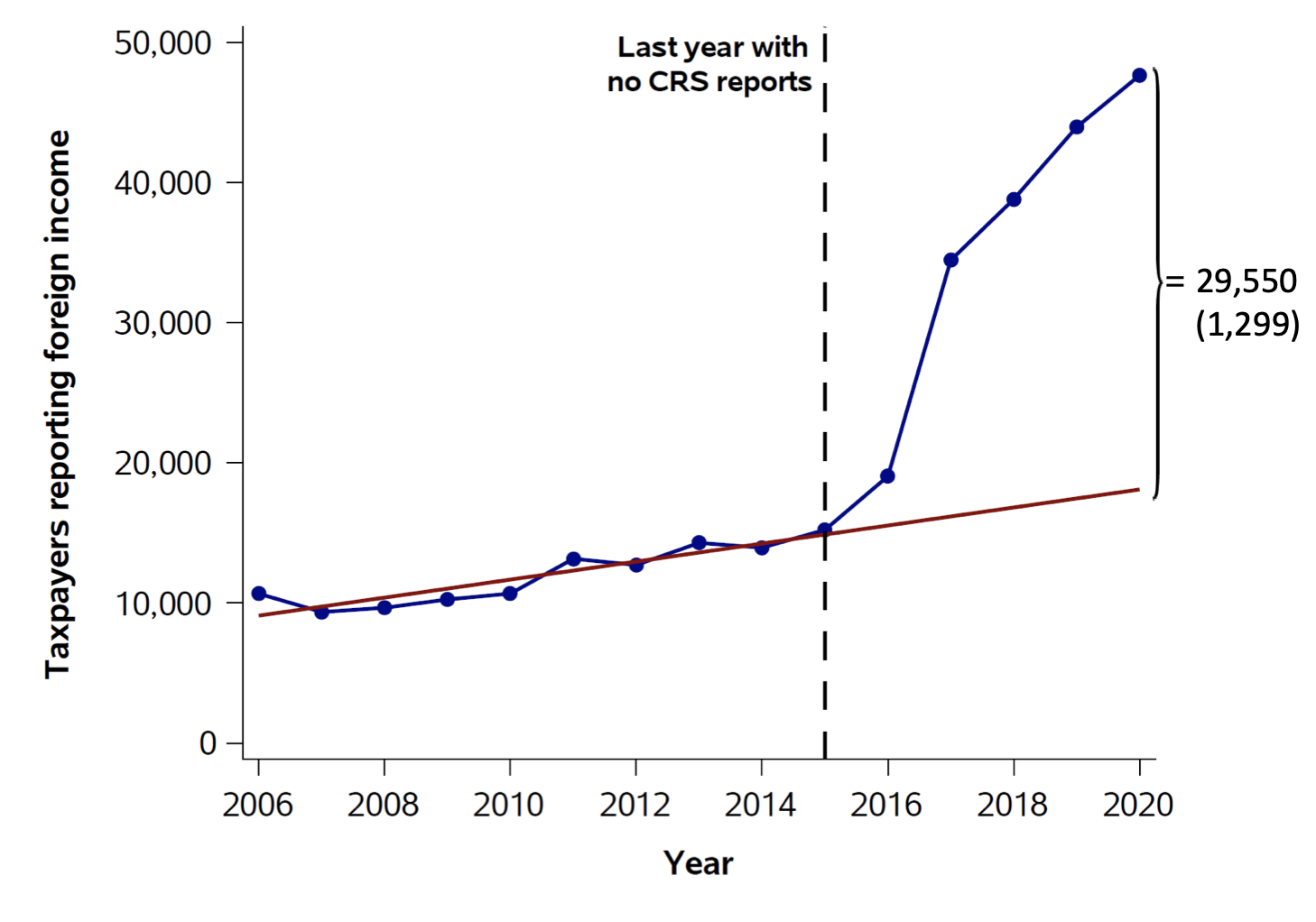

As shown in Figure 2, we observe a sharp increase in the number of taxpayers self-reporting any foreign financial income on their tax return coinciding with the beginning of automatic information exchange in 2016-2017. The number of self-reporters roughly tripled in a short time window.

Figure 2

Figure 2

We interpret the increase in self-reporting foreign financial income as taxpayer responses to information exchange. We provide two types of evidence to bolster that interpretation.

First, we consider separately cohorts of taxpayers who were treated at different points in time due to the staggered adoption of automatic information exchange among foreign counterpart countries. For each cohort, the sharp increase in self-reporting coincides with the first year of information exchange.

Second, we document clear self-reporting responses to letters sent out by the Danish tax authorities informing taxpayers that they have received an information report about a foreign bank account.

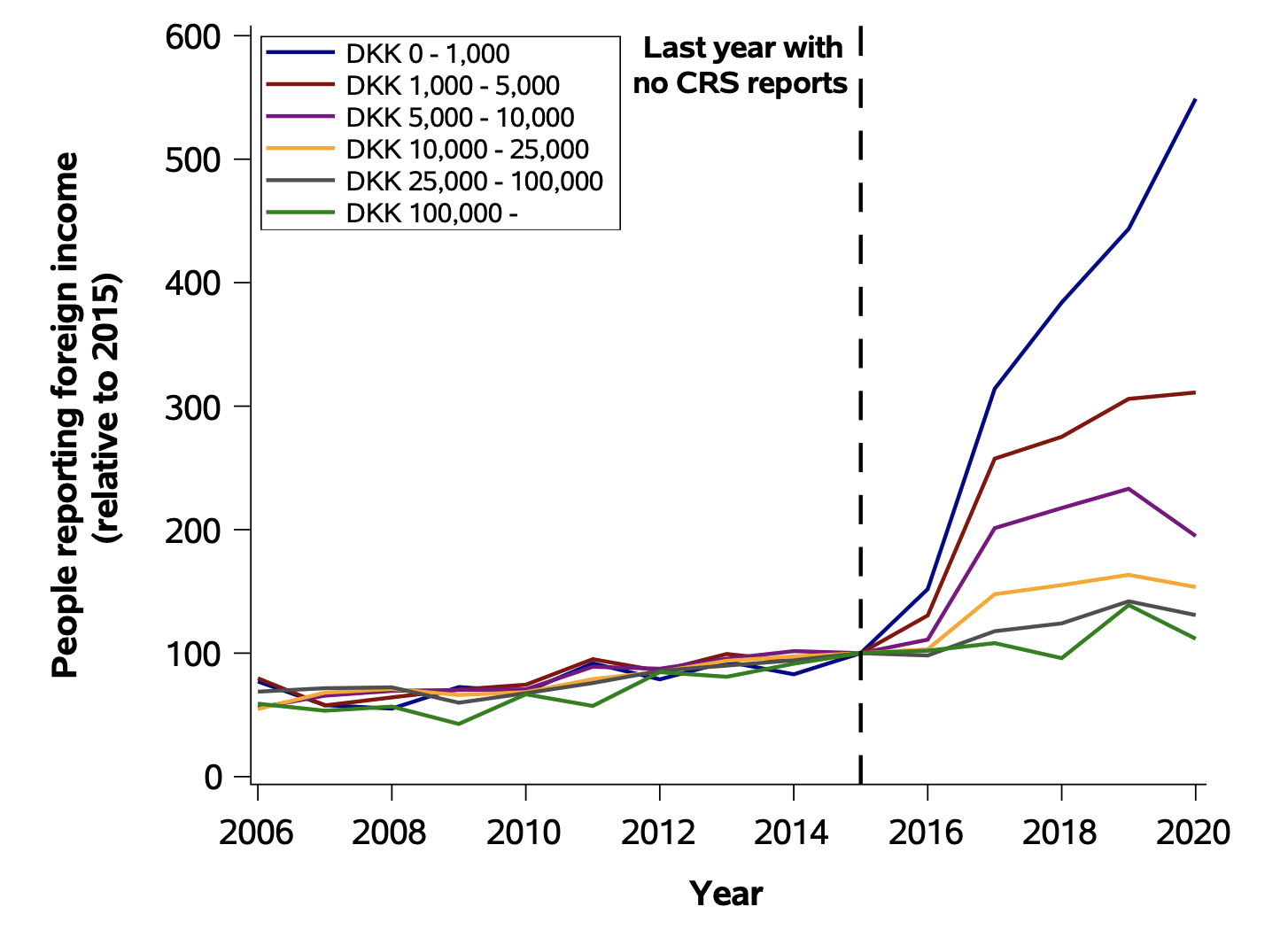

While the results imply that a large number of taxpayers have become compliant through self-reporting, the implications for revenue appear to be modest. This reflects that the increase in self-reporting is driven by taxpayers with low levels of foreign financial income, as shown in Figure 3.

Figure 3

Improved audits

Finally, we study the scope for detecting offshore tax evasion more effectively in audits that target foreign financial income and lever the new information about foreign accounts.

In collaboration with the Danish tax authorities, we design an audit effort that targets a random subset of the taxpayers, for whom a comparison of tax returns and foreign information reports suggests material tax evasion. Specifically, we select 500 taxpayers for audits among all taxpayers where interest and dividend income reported by foreign banks exceed foreign interest and dividend income reported on the tax return by the taxpayers themselves by more than DKK 5,000.

The audit results allow us to estimate the offshore tax evasion that the tax authorities could potentially detect through this type of audit effort due to the new information reports from foreign banks. Our results reveal a significant audit potential, but of a smaller magnitude than the other effects, potentially reflecting that large sums have already become compliant through repatriation and self-reporting.

Discussion

Combining the estimates from the various empirical designs, we conclude that automatic information exchange has closed around two thirds of the offshore tax gap in Denmark. Repatriations appear to make the biggest contribution to increased tax compliance but self-reporting and improved audits also play a non-negligible role.

This suggests that automatic information exchange is a relatively successful approach to tackling offshore tax evasion. This is notably the case when comparing to earlier policy approaches, which have largely failed (Oldenski et al. 2011, Johannesen, 2014; Johannesen and Zucman, 2014; Johannesen et al., 2020). Compared to domestic third-party reporting, however, cross-border information exchange still leaves a large room for non-compliance (Kleven et al., 2011). In the paper, we discuss different possible explanations.

It is important to emphasize that our findings do not necessarily extend to other countries. In particular, developing countries with less capacity to process information reports from foreign banks may benefit less from automatic information exchange (Johannesen, 2024).

References

Alstadsæter, A., Johannesen, N., & Zucman, G. (2018a). Tax evasion and inequality. VoxEU.org, 9 May.

Alstadsæter, A., Johannesen, N., & Zucman, G. (2018b). Who owns the wealth in tax havens? Macro evidence and implications for global inequality. Journal of Public Economics, 162, 89-100.

Alstadsæter, A., Johannesen, N., & Zucman, G. (2019). Tax evasion and inequality. American Economic Review, 109(6), 2073-2103.

Boas, H. F., Johannesen, N., Kreiner, C. T., Larsen, L. T., & Zucman, G. (2024). Taxing Capital in a Globalized World: The Effects of Automatic Information Exchange. CEPR Discussion Paper No. 19553. CEPR Press, Paris & London.

Johannesen, N., & Zucman, G. (2014). The end of bank secrecy? An evaluation of the G20 tax haven crackdown. American Economic Journal: Economic Policy, 6(1), 65-91.

Johannesen, N. (2014). Tax evasion and Swiss bank deposits. Journal of Public Economics, 111, 46-62.

Johannesen, N., Langetieg, P., Reck, D., Risch, M., & Slemrod, J. (2020). Taxing hidden wealth: The consequences of us enforcement initiatives on evasive foreign accounts. American Economic Journal: Economic Policy, 12(3), 312-346.

Johannesen, N. (2024). Offshore tax evasion in developing countries: Evidence and policy discussion. WIDER working paper 2024/15.

Kleven, H. J., Knudsen, M. B., Kreiner, C. T., Pedersen, S., & Saez, E. (2011). Unwilling or unable to cheat? Evidence from a tax audit experiment in Denmark. Econometrica, 79(3), 651-692.

Oldenski, L., Sly, N. & Blonigen, B. (2011). The growing international campaign against tax evasion. VoxEU.org, 26 November.

Zucman, G. (2013). The missing wealth of nations: Are Europe and the US net debtors or net creditors? Quarterly Journal of Economics, 128(3), 1321-1364.